Protecting Long-term Affordability by Closing the Qualified Contract Loophole

An estimated 10,000 units of affordable housing are being lost annually as a result of the qualified contract (QC) provision in the Low Income Housing Tax Credit (Housing Credit) program. Already facing a shortage of 7.3 million affordable and available rental homes for renters with extremely low incomes across the United States, this continued loss only deepens the affordable housing crisis and puts stable housing out of reach for even more Americans. Many states have already recognized this threat, and are taking concrete steps to staunch the loss. Housing Finance Agencies -- which administer housing credits – are in a critical position to adopt new policies in their award of Housing Credits to better protect affordable housing in their states.

What is a Qualified Contract?

The Qualified Contract (QC) provision of the Housing Credit program allows owners of Housing Credit properties to exit the program before fulfilling the promised length of affordability. Units in Housing Credit properties are intended to be affordable for a minimum of 30 years: 15 years of official compliance and a minimum 15 years of additional affordability during what is known as the “extended use” period. Housing Finance Agencies (HFAs) responsible for allocating the credits in their state can and often do require or incentivize affordability beyond 30 years, meaning that many Housing Credit property owners across the country have committed to maintaining these properties as much-needed affordable housing for more than 30 years.

After the initial 14 years of affordability, however, there is a dangerous loophole: owners are allowed to request a qualified contract ostensibly as part of plans to exit ownership of the property. This begins a one-year period during which an HFA is required to seek a buyer for the property. If the property is purchased through this process, the new owner is required to maintain the property as affordable for the duration of the promised affordability period. Unfortunately, this is rarely the outcome when an owner requests a QC. The sale price at which a property is offered during this one-year period is set by federal statute, and designed to give an inflation-adjusted return to the investor. More often than not, the resulting price far exceeds the value of the property and the HFA is unable to find a willing buyer. Consequently, per the rules, the property owner is permitted to convert the property to market-rate on a permanent basis.To date, over 100,000 affordable homes have been lost to QCs.

What are HFAs doing to protect properties from being lost through a qualified contract?

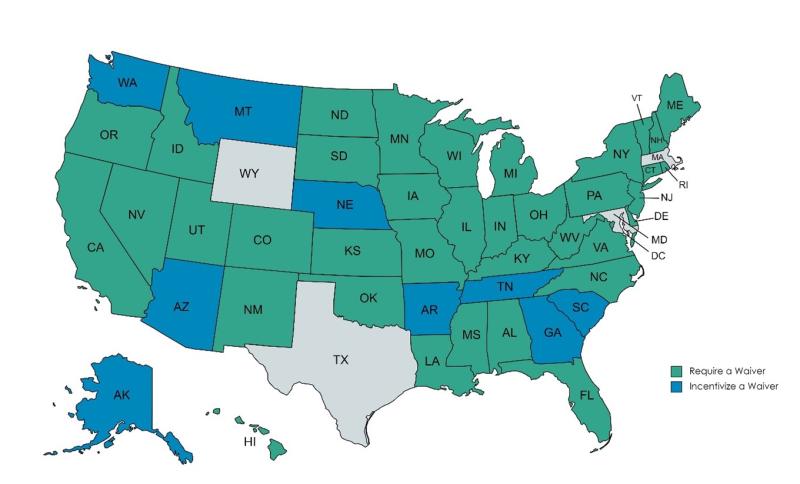

While National Housing Trust (NHT) and other advocates continue to urge Congress to close this loophole at the federal level, state and local HFAs are taking action to stop the continued loss of affordable housing in their state. A recent analysis conducted by NHT identified that at least 39 HFAs require an owner receiving Housing Credits to waive their right to a QC, effectively eliminating this option for Housing Credit properties receiving a new allocation.* An additional nine allocating agencies incentivize such a waiver by making it more likely that an applicant will receive competitive Housing Credits if they agree to waive their right to a QC. (see Figure 1)

Figure 1: States that Require or Incentivize a Qualified Contract Waiver (as of May 2023)

By requiring or incentivizing a QC waiver, HFAs are taking an important step in keeping their affordable housing stock accessible to low-income renters in their state. While these waivers protect properties receiving a new allocation of Housing Credits, some HFAs are taking creative steps to limit the loss of units in properties with an existing allocation, too. A growing number of HFAs are adopting policies to discourage existing owners -- who were not previously required to waive their right to a qualified contract -- from making QC requests:

- Indiana, Kansas, and New Hampshire each award negative points to applicants in their Qualified Allocation Plan who have previously requested a QC after a specified date;

- Maine and North Carolina disqualify applicants for new Housing Credit awards who have previously requested a QC after a specific date;

- Virginia both disqualifies applications from anyone participating in an active QC request and also holds the right to disqualify an applicant who, prior to a specified date, has previously made a QC request;

- Montana and Vermont maintain the right to disqualify applicants who have previously requested a QC;

- South Carolina awards points to project teams that have not previously requested a qualified contract.

Absent a federal fix to the QC, these represent important steps that state HFAs are taking to protect these affordable units and the families and individuals who call them home. NHT encourages all HFAs to include language in their Qualified Allocation Plans or accompanying documents explicitly requiring applicants to waive their right to a QC for the duration of the extended use period. To protect existing properties, HFAs should also follow the lead of a growing number of their peers by barring owners who have previously made a QC request from participating in the Housing Credit program. Without such action, the US will continue to lose critical affordable housing and residents will be left with even fewer stable housing choices.

NHT is committed to preserving the existing stock of affordable housing. We know that the qualified contract loophole isn’t the only threat the Housing Credit properties face as they approach the end of the 15-year compliance period. Together with HFAs, NHT has developed solutions that protect and strengthen the nonprofit Right of First Refusal. Learn more here.

This NHT Update is part of a recurring series focusing on solutions that promote Housing Stability. Each installment will share insights on potential solutions to four major threats to Housing Stability: reduced housing quality, the sale or conversion of affordable housing, climate change, and a lack of tenant protections.

Footnotes:

*Though most states’ qualified contract waiver is for the duration of the extended use period, some states’ waivers are only for a set number of years, meaning that a qualified contract is still an option, though only at a point later than the 14th year of compliance. In Alabama, for example, owners are required to waive their right to a qualified contract for only 4 years, meaning that a qualified contract can be requested 19 years after a property is placed in service. In Georgia, applicants are awarded points based on the length of time for which they waive their right to a qualified contract: a 5-year waiver earns 1 point, a 10-year waiver earns 2 points, and a complete waiver for the duration of the extended use period earns 3 points.

Senior Director of Housing Policy